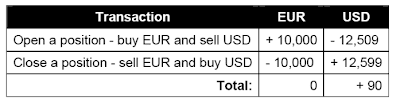

So, you speculate that EUR/USD is moving higher and you buy 10,000 EUR and sell 12,509 USD.

Assuming that you are right and EUR/USD reaches 1.2599/1.2603, you close the open position with an opposing one.

In our example, you close the long (buy) position with a short (sell) position, i.e. you sell 10,000 EUR (0.1 lot * 1.0 lot size for EUR/USD) and buy 12,509 USD:

You get a profit of 90 pips = $90 in this case. Importantly, you didn't require 10,000 EUR ($12,509) to make the trade, just $125.

A Pip or point is the minimum rate fluctuation. For EUR/USD, 1 pip is 0.0001 of the price (see Table 2). Our profit is 1.2599 - 1.2509 = 0.0090, i.e. 90 pips.

So, you invested $125 and made a profit of $90.

The time period to achieve this could be anywhere between a few seconds and several days. Assuming that it actually took a few hours, a profit of $90 for an investment of $125 and no actual “work” isn't a bad return at all.

However, you must be aware that leverage can also work against you and magnify your losses.

Only money management will help you to minimize the risks, ideally reduce them to zero, and increase the return from your funds to 10%, 20%, 30%, or higher each month.

One question is left: what is the broker's charge for the leverage they provide?

If you open and close a position before 23:00 GMT, brokers provide the leverage for free. If you leave your position open, they adjust your account with a storage charge for the overnight position. It can be either positive (credited to your account) or negative (debited to your account) depending upon the interest rates in those countries.

For example: ECB interest rate is 4.25%, FED interest rate is 3.5%. Assume you have a short position on EUR/USD of 1.0 lot so you have sold 100,000 EUR. This means you have borrowed them at 4.25% per annum.

You sold Euros and bought Dollars, which can be deposited at 3.5% per annum. As a result, the costs are (4.25% - 3.50%) per annum or $937.50 per year (if the EUR/USD rate is 1.2500), or $2.57 per day.

This means that your account will be debited with $2.57 every day for each lot if you have a short (selling) position on EUR/USD and credited with $2.57 if you have a long (buying) position.

In practice, the debited amount is a little higher than 2.57% and the credited amount is a bit lower. The difference goes to a broker as a payment for the rollover.

Swaps

Note: the storage charge for the rollover from Wednesday to Thursday is three times higher than for a position held over any other night.

This is because in the spot currency market, the funds ordered when you open a position are not received until 2 business days after the position is opened and by the same token, if you close a position, the funds are not returned for 2 business days.

For positions opened on Wednesday and closed on Thursday, that would mean receipt on Friday and, therefore, rollover would be for Friday, Saturday and Sunday nights before being returned on Monday. Sorry if that seemed overly complicated – it probably was!

The main thing you need to remember is that you will see a much larger rollover charge if you hold a position over Wednesday night.

0 comments:

Post a Comment