That’s what we’re going to risk on our next trade. That’s what we must base our trade on. A loss of $10. We’ll come back to this in a minute.

My strategy is based on crossing horizontal lines I call “latitude Lines.”

As a pilot, if I’m flying from Seattle to Los Angeles I’m going to cross several latitude lines as I fly South, i.e. down.

I’m not going to turn around at San Francisco, because that’s not my destination. I’m going to keep flying until I reach Los Angeles.

If I’m flying from Miami to New Jersey I’m not going to turn around at Charleston, South Carolina. I’m going to keep going North! You get the picture.

And that’s the way it is with trading. Many potentially good traders are always thinking to take a profit too soon – before they reach their final destination.

What we’re going to show you is how to reach your destination by using a roadmap of prices on a chart!

What do prices look like when they’re moving up and down? There are several kinds of charts, the most popular being the bar chart. The top of the bar is the high for the day, the bottom the low.

On the right side a small tick is made indicating the close. Sometimes a tick is made on the left side indicating the open price.

Another type of chart gaining popularity – and the one I use – is the "candlestick" chart. The body of the price shows the open and closing price. If the body is black it means the close was lower than the open. On our Forex chart the body is red instead of black ifprices are falling.

The body is blue if the close was higher than the open. The so called shadow or "wick" at the top and bottom indicates the high and low for the period.

Let’s compare the two types. This is a bar chart:

The same chart as above in candlestick form looks like this:

Chart 2

We use a combination of three charts. A 15 minute, (each bar is 15 minutes in duration) a 5 minute and a one minute chart.

We use the 5 minute chart to trade with, the 15 minute chart to help us determine the trend, and the one minute chart to help us enter the trade at the right time.

First, however, we have to set up our so called “Platform”. It looks like this. Click on all the buttons to get a feel of how everything works. This is where we pick and choose to place, change or delete our trades.

For example, if you click on the tab marked “Activity” you’ll be able to see all the activity that has happened in your account in the past. It includes all interest payments, orders, fills, etc. You can also choose what you want it to display by clicking on the small icon on the right after selecting “Activity.”

The tab marked “Orders” displays the orders you have placed. The “Trades” tab shows the open positions that are in play.

The Quote Panel tells us the spread between prices (It’s showing ten because it’s a weekend). During trading hours it usually shows 1.2, one of the lowest spreads in the industry. If things get volatile, like a wild report, it expands. Sometimes to 15!

We want to avoid trading during that time. Our stops will be too far away.

Now, let’s discuss each of our charts in turn starting with the five minute chart.

To create a new chart we click on the icon just above and to the right of any chart displayed, including our platform. It looks like this:

We can then begin to set up our chart with the tools we use to make our trade. For example, we select a time frame of 5 min . . EUR/USD . . CandleStick.

Chart 4

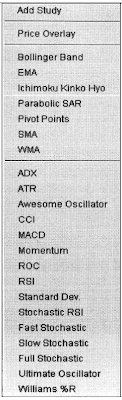

Notice the wavy line at the bottom. This is an indicator I use to help me determine where prices might be headed. It’s called stochastics. It’s generated by clicking the box at the bottom left labeled “add study.” This brings up a variety of indicators you can use to help guide you as you trade. Displayed on the right side they look like this:

Over the years I’ve checked out nearly all of them and found while most are helpful most of the time, you can’t depend on the majority of them. I use only a few.

For example, moving averages are somewhat dependable in determining the current direction of prices. There are two types, exponential and simple. At best they keep me from putting on a trade in the wrong direction.

At their poorest, they lag in showing a change of direction quickly enough for a trade. In a minute I’ll show you how I use them. And, by the way, I alter all the parameters of any indicator I use.

Now we have to draw some horizontal lines on the stochastic indicator at the bottom of the chart.

To do that, move your cursor down to the stochastics area and left click the chart. Select “Horizontal trend line.” It will be yellow. Then move the line to around the 80.00 level. Do the same thing again at the 20.00 level. It doesn’t have to be exact.

Do the same thing again only this time select the 50.00 level and change the line to green. You do this by clicking on the line and selecting a colour.

The area above the green line is generally where you would be looking to sell rather than buy. Below the green line is the buying area.

You see, one indicator alone is not the “yellow brick road” to riches. If it were there would be no markets. That’s why we use several indicators – including the price action itself – to make a “best guess” scenario for ourselves. After that it’s how we handle the gain or loss that will determine our success.

Next, we’re going to create two exponential moving averages by clicking on “Add Study,” then EMA. You’ll see EMA . . 14. Change the 14 to 20, click on the + sign and then change the line’s colour by clicking on the line and selecting green.

Do the same thing again, but this time change the 14 to 30 and colour the line red. What we’re doing here is creating a longer term line based on 30 bars that is red. Take a look at this screen. Notice the moving average lines are generally moving higher.

Chart 5

But, more important, the red line is below the green line. As long as this continues we would expect prices to move higher. Here is a blow-up of the chart.

During the early morning we would only BUY this pattern. Note how many opportunities we have to buy the latitude lines. Then, around 7:00 AM a report comes out. The spread widens to ten and after some backing and filling prices begin to drop. Notice how they are unable to better the seven o’clock high? That’s what we mean when we talk about watching the price action. Shortly after the EMA’s cross one another.

Which brings up the next tool we use – connecting the highs and lows of prices. This is sometimes a little hard to judge, but basically we left click on the chart, select “Draw Trendline” and move the cursor to a high or low and click again. Then drag the line to the next high or low.

After a few practice tries it will become easier. These lines are important because they show us if we are getting higher highs or lower lows. We always want to be trading in the direction (the trend) of prices.

Another thing you’ll notice when drawing trendlines is that prices will usually retract or rally roughly half-way the distance from the previous move. This can be helpful when picking a latitude line to trade. Lastly, to finish setting up our chart, we need to create the latitude lines themselves. Although they look like they’re automatically drawn, they’re not. We have to do it ourselves. And there’s a reason for that.

Most of the time I construct them in five pip increments. But sometimes, when things become really wild, I’ll use a ten pip increment. When things become slow, I’ll often use just three pips between latitude lines.

To do this we left click on our chart, select “Horizontal Trendline,” and move the line to the price we want. Then click on the line and change the colour to blue. To draw another latitude line just click on any line and select “Duplicate.”

Once again, I apologize for being so redundant but I believe you must be consistent each time you trade. For example, I believe one of the biggest faults a good trader can have I thinking the money he has earned is “house money,” like cash won at a casino.

That money isn’t theirs anymore. It’s yours! You’ve got to protect it. And you do that with good old-fashioned discipline. For example, I have no trade going as the 7:00 AM report period approaches. Sure enough, it shocks the market.

Stochastics had already been in a decline and failed to better their 6:00 AM high. A comfortable divergence had occurred when prices rallied but stochastics did not. By the way today is Monday, June 25th. I’ve been writing this report for about two weeks now. Seems like only yesterday I showed you my pizza trade. This one reminded me of that. Now that you have an idea what this is all about you can understand the trade a little better.

I placed an order to sell at the 1.3460 line and buy at 1.3455. Here’s the trade:

You can also see the Moving Averages crossing over. The red line is now moving above the green, signaling a decline.

You’ll note we did not have any other trade going when prices fell from roughly 1.3465 to 1.3445, a drop of 20 pips. We don’t need to and we don’t much care. We’re only interested in that five percent per day (which in this case we’ve already earned).

Once we’ve set up our 5 minute chart we can click on the chart icon and duplicate the chart. Then change it to 15 minutes. Do it again and change it to one minute.

We now have three charts with different time frames that we can use to anticipate what latitude lines we will use and the direction we should follow. By moving the sides of each chart (the windows) we can look at all three as we trade, as it shows below.

Before I finish Organizing our Trade I want emphasize how important it is to have everything working for you – “in-sync” so to speak. Watch all three stochastic charts, moving average cross-overs, etc. Remember you only need 2-3 good, solid trades to meet your 5% goal.

0 comments:

Post a Comment